About Us

OneVentures is one of Australia’s leading venture capital firms, with over $750M in FUM.

But we do more than invest. We take companies to that all important next stage, by actively shaping their future.

We apply our years of international experience, operational and executional expertise to accelerate the growth of our portfolio companies.

A global growth focus drives our investment selection with our current portfolio including companies with truly innovative products tackling multi-billion-dollar problems, from needle-free vaccinations to virtual communications to adaptive e-learning.

What we do

OneVentures provides equity and credit funding to tech and tech-enabled companies and for healthcare companies, we offer equity financing.

Our Investment Pillars

01 Growth Equity

02 Growth Credit

03 Healthcare

01 Growth Equity

Venture Equity Financing for Transformative Technology Companies

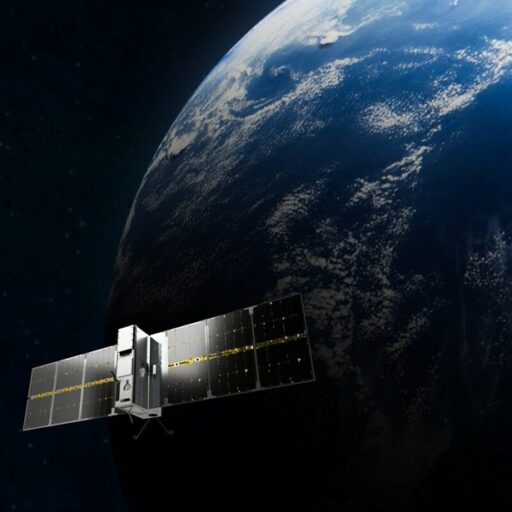

OneVentures has a passion for technology and innovation. The companies we invest in are high quality scale-up technology businesses, many who may require support with corporate restructuring, offshore market entry and expertise to accelerate their next phase of growth. OneVentures’ operational and strategic expertise is provided in partnership with the leadership teams of our portfolio companies helping them to unlock their full potential.

Our investment strategy considers major global thematics such as remote workforces, rapid digitisation, clean energy transition, urbanisation, aging populations, access to education and affordable healthcare. Companies selected for the portfolio provide an innovative product or service with a positive benefit to society.

Funds

2010 AU$40M Innovation Fund I

2014 AU$75M Innovation & Growth Fund II

2020 AU$142 Growth Fund V

Funds

2020 AU$80M Growth Credit Fund IV

2021 AU$30M VGF Credit Fund

2023 AU$150M (target) Growth Credit Fund VI

02 Growth Credit

Venture Credit Financing for Scaling Technology Companies

OneVentures are a market leader in providing venture credit in Australia. When our first Credit Fund ($80M) established in 2019, we enabled access to alternative funding options whilst also offering the mentorship and business advisory that is more usually associated with Venture Capital investment. One of the key advantages of Venture Credit is that it provides capital without forcing founders to give up equity in their business.

We have since launched two additional funds: Growth Credit Fund VI targeting $150M, and the VGF Credit Fund (in Partnership with the Victorian Government), managing the deployment of $30M in funding.

We believe that great innovation can scale with the help of some innovative funding.

Our growth credit funds provide loans to rapidly growing companies that are differentiated through technological innovation, with strong revenue growth.

03 Healthcare

Venture Equity Financing for Advancing Healthcare Companies

OneVentures has a long history of supporting healthcare and bio-tech innovation. By bringing hands-on business experience and providing mentorship to key senior leaders, our contribution alongside our capital investment is designed to give their companies the best possible probability to succeed.

We actively support innovation in companies who are changing the way patients will be treated in the future, ultimately providing better healthcare outcomes around the world. We understand that venture capital is a critical component for the progress of biotech innovation, providing both expertise and capital to help drive the success of businesses.

Funds

2010 AU$40M Innovation Fund I

2014 AU$75M Innovation & Growth Fund II

2016 AU$170M Healthcare Fund III

How we work

Our results

We cultivate enduring relationships with founders and help them create legendary companies.

Ventured. Gained.

Subscribe to our Newsletter.