Healthcare investments at record highs amidst SARS-CoV-2 pandemic

Unlike 2008, the current crisis is of biological nature as opposed to a financial one — even if many argue that current government spending may be insulating markets from economic weakness in some fundamental measures that have not truly recovered since the global financial crisis.

Be that as it may, the pandemic has drawn even greater interest in novel healthcare technologies than there was in previous years.

We think of ourselves more as investor-practitioners in that we’re always looking to grow companies (and invest in promising research) with the potential to change lives. Here’s what we think about the healthcare investment space amidst the Covid-19 crisis.

What we’re seeing globally

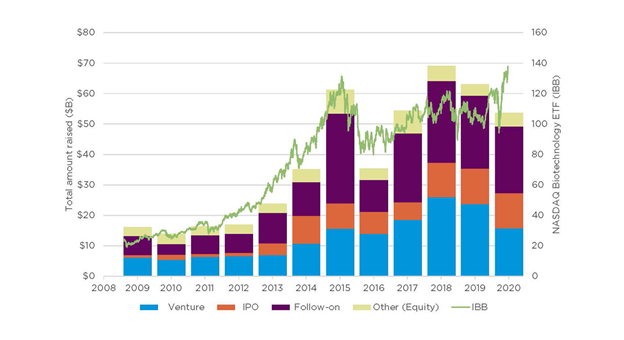

When looking at the US market, a quick glance at the major indexes as indicators shows that the biotech sector has consistently outperformed other industries in the ongoing pandemic. Comparing the S&P 500 index relative to the NASDAQ Biotechnology index (NBI), the former had a 2% decrease relative to its peak prior to the bottom reached in March, compared to a 10% gain for the NBI from that same low point.

This impressive performance is also put in context when considering that the NASDAQ 100 Technology Sector index(NDXT) only increased by 5% on that same measure. (The NDXT is a good comparison as, unlike the NDX, it doesn’t include Health Care companies, as defined by the Industry Classification Benchmark [ICB]).

In mid-July the NBI reached an all-time high, surpassing the mark it had reached in July 2015. When writing this article, it stood a just 1% below that 2015 record.

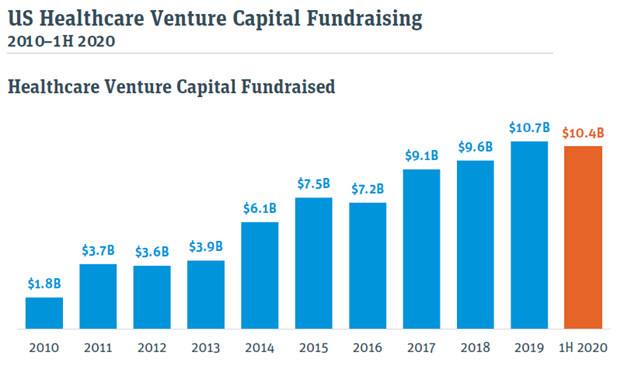

Capital raising for new Healthcare VC funds

Healthcare Venture Capital fundraising has followed the same trend. The amount of capital raised for new funds in the first half of 2020 was almost on par with the full year amount for 2019, including US$840M raised by Deerfield, who co-led Blade Therapeutics’ with OneVentures in 2018.

Financings: record-breaking venture funding and IPOs

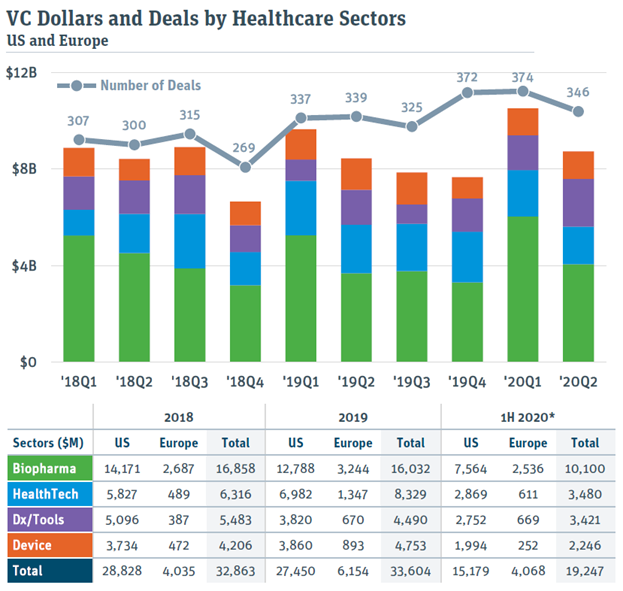

Deal activity has followed suit, with 1H 2020 producing the highest ever cumulative amount of venture capital invested in healthcare companies, over a 6-month period.

One point to note is that it’s not clear what the purpose of those financings was. In many instances, it may have been investments in existing portfolio companies to shore up their cash position in the face of uncertainty. In fact, this is something we did for our own investee companies, alongside helping them navigate the crisis by thinking creatively (see 12 Tips for Startups to Navigate the COVID19 Crisis).

But looking beyond venture funding, it is clear that broadly, investors worldwide, both specialists and generalists are looking to healthcare, and biotech in particular, as not only the saviour of the COVID-19 pandemic, but to generate significant returns in their portfolios. According to an analysis by BioCentury, in Q2 alone, biotechs raised $7.5 billion through 34 IPOs, nearly double the previous record for a single quarter in the past decade, when 28 companies had raised nearly $4.2 billion in the same quarter last year.

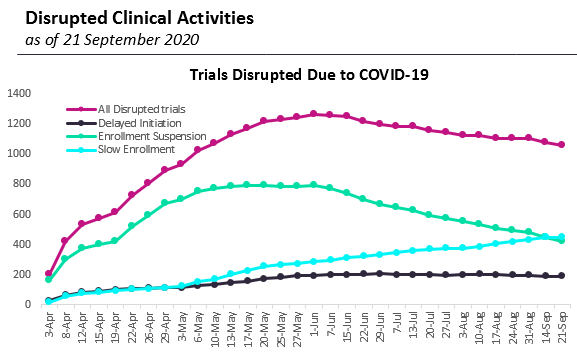

Clinical trials

As of September 21st, GlobalData reported that 1,054 trials were currently disrupted worldwide, which includes: delayed initiation, enrolment suspension and slow enrolment. This is a decline from the 1,265 peak in early June. To put this in perspective, however, this only represents only 3.2% of all 32,521 trials that were registered on ClinicalTrials.gov in 2019 (2,710 per month). 2020 seems on track to match this yearly number, standing at 27,018 as of September 24th (2,251 per month so far). Of course, 3,258 of the trials registered so far this year are for SarS-COV2 vaccines or COVID-19 treatments, as per GlobalData, which makes it unclear if some trials have been deprioritised and not even planned by sponsors, which the disruption data may not capture.

Here’s what we’re seeing in Australia

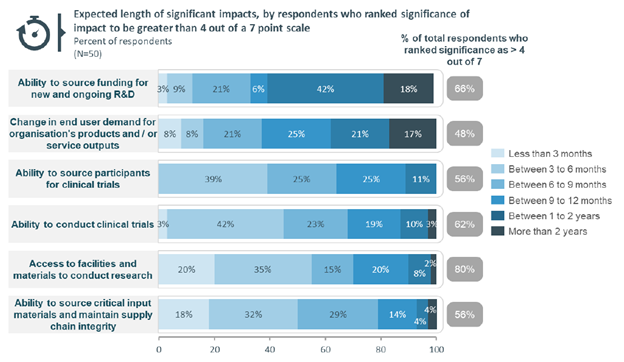

In Australia, despite a relatively low number of cases, disruption to clinical trials and other aspects of the research and development value chain are being felt.

In their COVID-19 Impact Report, MTPConnect showed particular wariness around the ability to source funding for new and ongoing R&D.

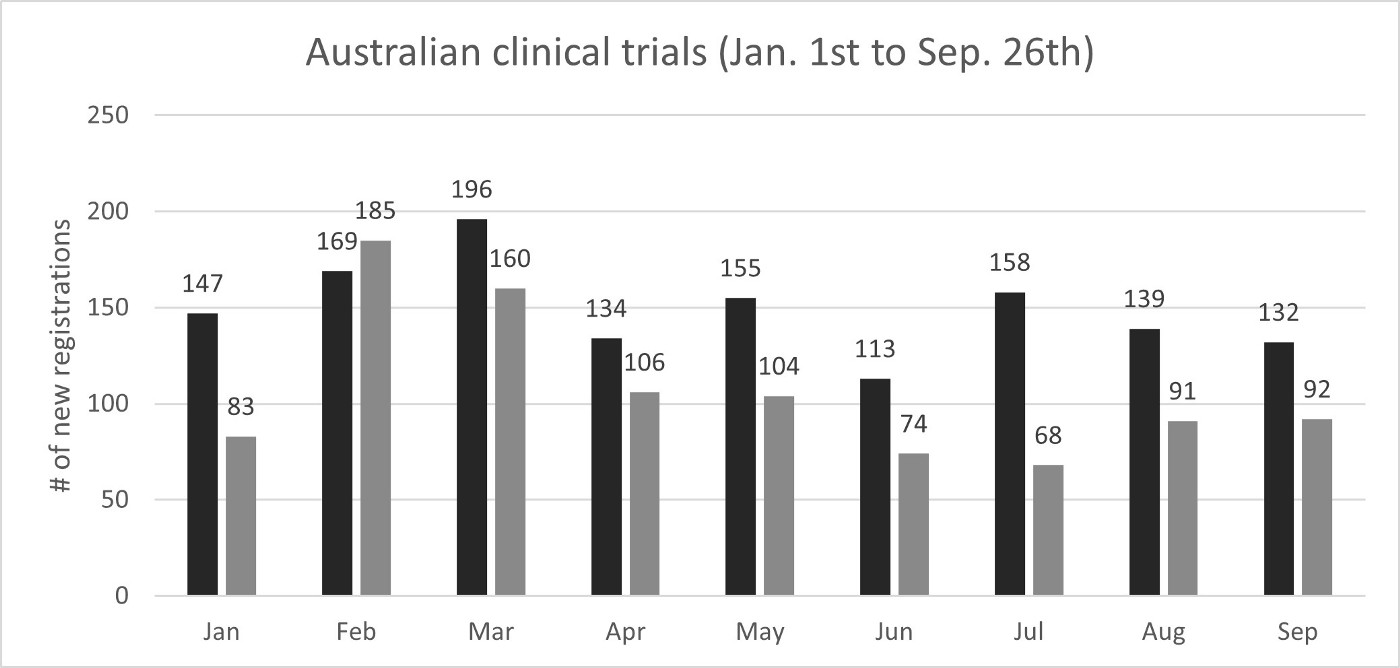

Looking at an objective measure of impact on clinical development activity, the number of new clinical trials registered in Australia (medicines, devices and biologicals) from the period spanning January 1st to September 26th has been 963 in Australia in 2020 relative to 1,319 in 2019, a 27% decrease (356 fewer registrations, see first graph below). It is indeed a material impact and reflects the sentiment from the MTPConnect survey. The monthly number of new registrations has been decreasing throughout the year since February, with July also being the lowest on a percentage difference basis compared to the same monthly tally from 2019. New trial registrations are increasing once more, but still not up to the activity level seen last year (see the second graph below). The recovery will be something to monitor and for all stakeholders of the Australian ecosystem to support.

So, what does this mean for us locally?

Despite setbacks within the industry we still believe that the infrastructure is in place to perform important life science technology development and that there’s clearly an appetite (our own included) to continue funding ground-breaking innovations to address clear unmet medical needs.

The Federal Government has committed $2.4Bn in healthcare funding (which includes telehealth systems funding) and clinical trials conducted in Australia represent an AU$1 billion investment each year (AusBiotech). In addition to programs such as the Research and Development Tax Incentive (RDTI)We believe we are well poised relative to other countries to keep charging ahead in developing new therapies and diagnostics.

We believe in long term impact over short term gains.

Please reach out to us with your investment proposals — we’d love to hear from you.

Find out more about our investment process and our funds.

You may also like

Ventured. Gained.

Subscribe to our Newsletter.